20+ Mortgage preapproval

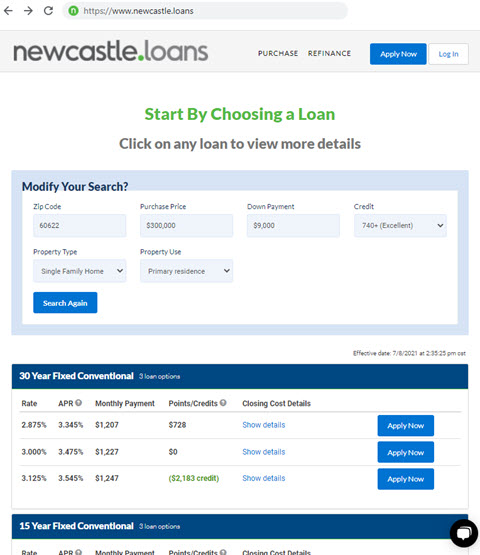

Unlike government-backed loans you wont pay any private mortgage insurance. Get preapproved for a mortgage Enter your ZIP and get matched with the lenders that are right for you.

Central Park Tower Loses Its Spire Will Stand 1 550 Feet Supertall Tower Pearl River Tower

When you are pre-approved for a mortgage it means a lender has determined how much you can borrow the loan programs that you may qualify for as.

. This same time last week the 15-year fixed-rate mortgage was at 541. Unlike the prequalification process there are some standard documents youll need to submit for a mortgage preapproval. A basis point is equivalent to.

A conventional mortgage preapproval is a good option if. 60 days of bank statements. Gather the following documents required for pre-approval and final loan approval.

It is a formal process where you have to submit a host of documents. 1 Answer a few questions Click the get started button to answer a few questions about your loan requirements and tell us. A mortgage preapproval is an assessment of a prospective borrowers financial health and credit history which determines whether they are an attractive candidate for a mortgage loan.

Being prepared and organized will make the application process easier. The borrower must submit financial records such as credit reports and proof of income assets and identity with their preapproval application. Mortgage pre-approval means a lender has reviewed your finances and based on factors like your income debt and credit history determined how much.

The 30-year fixed-mortgage rate average is 633 which is an increase of 23 basis points from seven days ago. Our online application streamlines the process from start to finish. Get your Free Pre-Approval Today.

Preapproval is a letter from a lender that outlines the amount of loan youre qualified to borrow or in essence how much home you can afford. What is a Mortgage Pre-Approval. Getting started is easy.

Potential borrowers complete a. Heres a list of documents that you need to present to be pre-approved or to secure final loan approval before closing. Bank statements 60 days Pay stubs 30 days Tax returns past two tax filing years Form.

However other documents may be required depending on the type of loan you want to get the type of residence you wish to buy and the kind of work you do. Most of these are standard for all borrowers. Tax returns for the past two years and all schedules if you are self-employed or have rental income.

It means the lender did a deep dive. Prefer to apply over the phone. 30 days of pay stubs.

A mortgage pre-approval shows home sellers that you have your finances in check that youre serious about buying a house and that you wont be denied a mortgage if they. You have a 20 down payment. Employment history Your current means of income is a highly.

2 days agoThe average interest rate on the 15-year fixed mortgage is 570. It typically includes a maximum loan amount interest rate and any other relevant terms or. Give us a call at 800-353-4449.

Mortgage pre-approval is an examination of a home buyers finances and lenders require five items to ensure borrowers will repay their loan. Mortgage pre-approval is the process of the lender providing you a loan estimate based on your financials. A mortgage preapproval is a letter from a lender indicating that you are tentatively approved for a loan.

Mortgage statements and homeowners insurance for any property you will continue to. 2 days ago30-year fixed-rate mortgages. Less than 20 is considered excellent while DTIs greater than 45 are typically the maximum percentage for preapproval.

Submit documents and get updates on the status of your loan all without leaving the comfort of your own home. Todays rate is higher than the 52. Get my lender matches Heres how it works STEP 1 Answer a few questions Tell us.

Here is one way to start the mortgage pre-approval process online.

What S The Difference Between A Preapproval Prequal

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

9 Steps To Buying A Home Great Info For First Time Home Buyers Need To Get Pre Approved Let S Chat 949 600 0 First Time Home Buyers Real Estate Home Buying

Mortgage Loan Approval Process Explained The 6 Steps To Closing The Hbi Blog Mortgage Loans Mortgage Approval Mortgage Loan Originator

How To Get A Mortgage In 8 Steps

How To Get A Daca Mortgage Loan

How To Get A Mortgage In 8 Steps

Mortgage Closing Checklist Everything You Need To Know About Your Closing

List Of Documents For A Mortgage Loan Getting Into Real Estate Buying First Home Real Estate Terms

B2b Data Services

How And Why To Get Pre Approved For A Mortgage Preapproved Mortgage Real Estate Marketing Plan Buying First Home

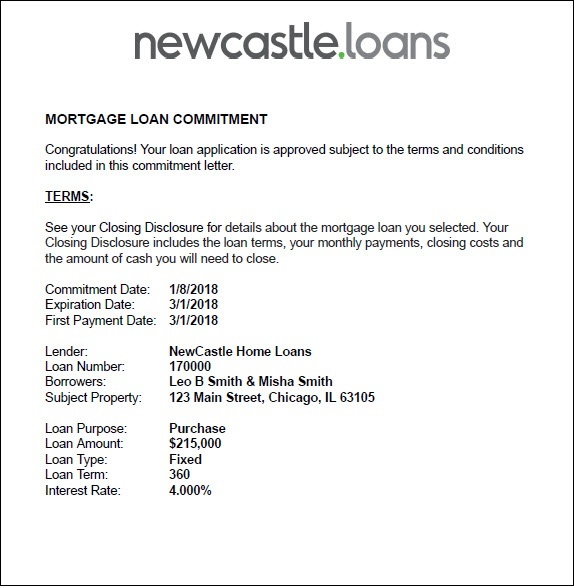

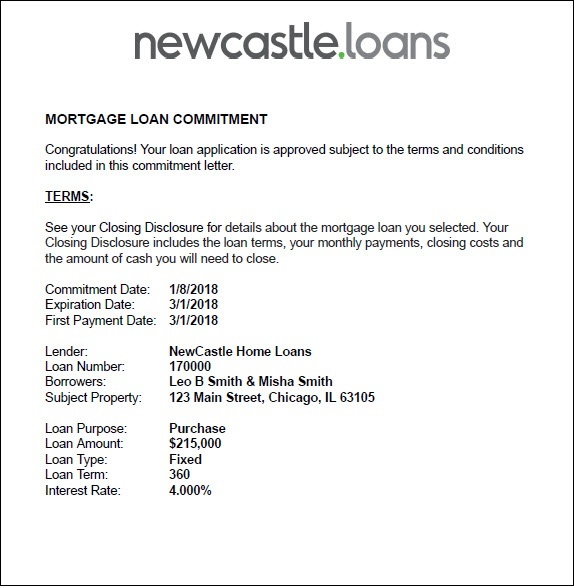

Understanding Your Mortgage Commitment Letter

Mandatory Mortgage Documents Preapproved Mortgage Mortgage Mortgage Tips

When And Why Should I Get Pre Approved For A Mortgage Preapproved Mortgage Mortgage Refinance Mortgage

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

The Difference In Being Prequalified Vs Preapproved For A Mortgage Home Buying Preapproval Home Loans

Mortgages For Condos What You Need To Know Mortgage Mortage Condo